Business Loan Service

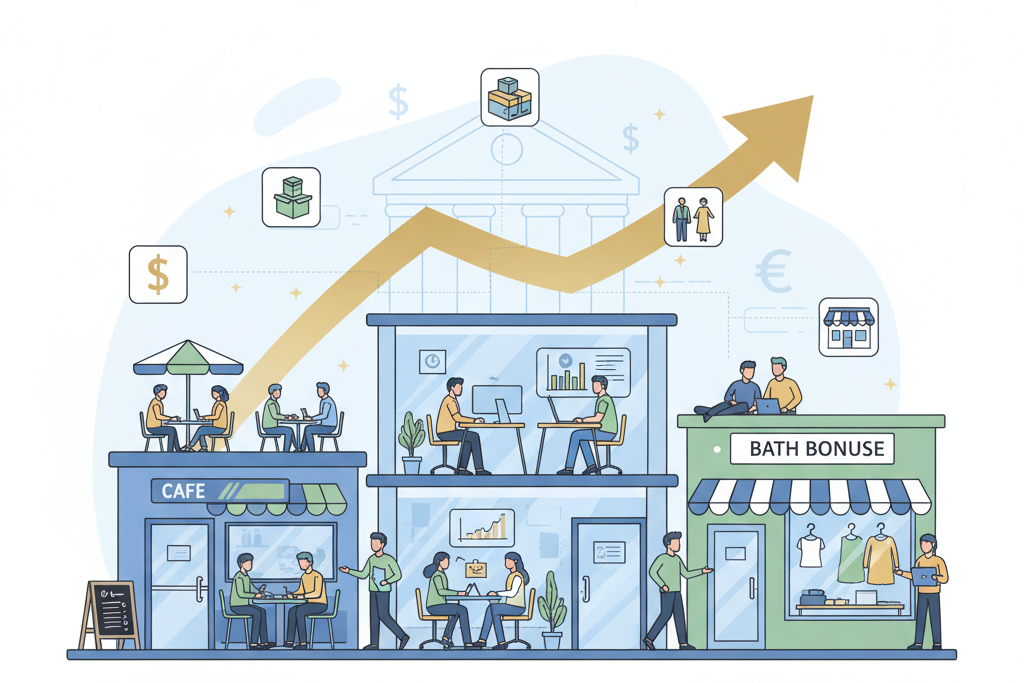

🚀 Business Loans to Power Growth

Fuel your startup, scale operations, or manage cash flow with ease. Smart financing solutions tailored for entrepreneurs, SMEs, and professionals.

Working Capital:

Maintain smooth operations with short term funding support.

Expansion Support:

Finance new branches, equipment, or business upgrades.

Startup Boost

Get early stage funding with fast approvals and flexible terms.

Equipment Finance:

Upgrade machinery or tech without upfront capital strain.

Banks and financial institutions have set personal loan eligibility criteria to ensure smooth loan approval and repayment. Apart from these criteria, lenders also assess the applicant’s credit history to evaluate creditworthiness and repayment behavior.

General Eligibility Criteria:

- Applicant must be between 21 to 60 years

- Salaried or self-employed with a stable income

- Minimum monthly/annual income as per lender’s requirement

- Good credit score (typically 700 or above)

- Employment stability and continuity in work

- Indian resident or NRI, depending on lender policies

To apply for a personal loan, applicants need to submit specific documents for verification. These documents help lenders assess eligibility, creditworthiness, and repayment capability.

Identity Proof (Any one of the following):

- PAN Card

- Aadhaar Card

- Passport

- Voter ID Card

- Driving Licence

Address Proof (Any one of the following):

- Utility Bills (Electricity, Water, or Telephone Bill)

- Aadhaar Card with Address

- Bank Account Statement

- Rental Agreement

Income & Employment Proof:

- Salaried Individuals:

- Salary slips of the last 3 to 6 months

- Form 16 or Income Tax Returns (ITR)

- Latest bank statements showing salary credits

- Self-Employed Individuals:

- Business continuity proof (at least 3-5 years)

- ITR for the last 2-3 years

- Audited profit & loss statement

Other Documents:

- Passport-size photographs

- Duly filled loan application form

Types of Business Loans We Offer

Machinery Loan

Upgrade or purchase business equipment with ease.Flexible EMIs and fast approvals for asset-heavy sectors.

Startup Loan

Early-stage funding for new ventures and entrepreneurs. Minimal paperwork with tailored repayment options.

Line of Credit

Access funds as needed with flexible drawdowns. Ideal for managing seasonal cash flow or unexpected expenses.

GST Business Loan

Loans based on GST returns and turnover. Perfect for small businesses with limited documentation. and easy EMI option to pay off with ease.

Retail Loan

Tailored for shop owners and local traders. Finance inventory, renovations, or daily operations. Empowering the workers to build their dream.

Our Trusted Network

How to Apply for a Business Loan

Get your loan approvals in 3 instant steps.

Fill A Quick Online Form

Complete a form with your name, phone number, and city.

Get Verified

Our system swiftly processes your application and verifies your contact details.

Get Instant Loan Assistance

Receive a call from Smart Digital Loans Experts within 24 hours.

One click away from your dream

Fill the the form to get quick loan approval

Here from Our Loyal Customers

Making Dreams Come True

Buying our first home was a dream, but we were terrified of the loan process. Smart digital loans changed everything. Their online platform was so intuitive we uploaded documents from our living room and tracked our application in real time. We got approved faster than we ever thought possible. We're unpacking boxes in our new house, all thanks to their speedy and transparent service!

As a small business owner, I needed capital quickly to scale up for a big order. Traditional banks were too slow. Smart digital loans understood the urgency. The application was straightforward, minimal paperwork, and I had the funds in my account within 48 hours. They didn't just give me a loan; they gave my business an opportunity to grow.

I found the perfect car but dreaded the financing. I applied for a car loan with Smart digital loans on my phone while I was still at the dealership. I got pre approval in minutes! It gave me the bargaining power I needed and I drove off the lot the same afternoon. Incredibly easy and lightning fast.

We needed funds for our daughter's overseas education and decided to take a loan against our property. The team at Smart digital loans was professional and clear about the valuation and terms from day one. The entire digital process was seamless, and we secured the funds without any hidden fees. They helped us invest in our daughter's future.